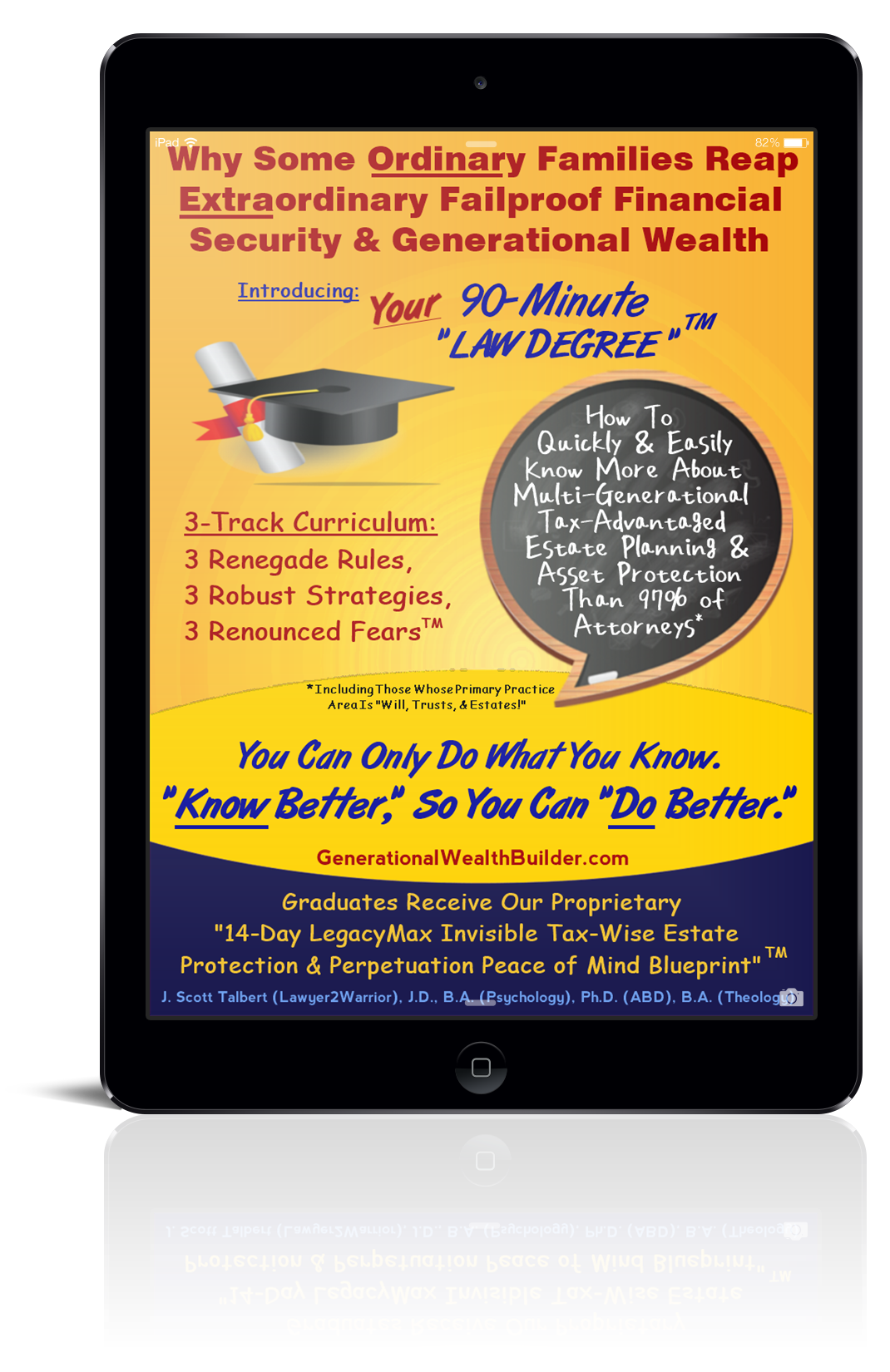

Let's Preview

1 of the 9 Courses

Join the master class

"Watch me create ad copy, webinar slides, done for your courses, complete 27-step email nurture sequences, sales scripts and more - on autopilot in no time, flat. No blank screens ever..."

Meet Generational Wealth Builder's Founder...

... and the Creator & Teacher of Your 90-Minute "LAW DEGREE"

Hey there! I'm Scott Talbert, "distiller" of Your 90-Minute "LAW DEGREE." Yes, I am quite literally the "apparatus" that condensed & purified massive amounts of material into its potent, component parts. I created this unique edcuational experience to help anyone who expects to die some day access this critical information - before it's too late.

Before I was one, years ago I hired an attorney half-way across the country to help me. That was after buying, reading, and rejecting the "solutions" shared in a number of books. Some were sketchy; others were unwieldy and unappealing. I basically knew the end goal, but lacked a clear way to "get there from here." I ended up working closely with this lawyer to put together a package that ticked all known boxes.

Next, I up & went to law school myself. I'd already studied the matter way more than most, but figured pursuit of a JD would be the best way to not only test my Trust/LLC Structure, but also see if - by chance - I could find something better. I took all the right courses - legal drafting, contracts, business associations, tax, more tax, estate planning, and so on. Not only did I not find anything better, but I also could not find a way to improve upon what I had (and netiher did I have a need to - for it'd never let me down or left me wanting). In fact, my estate planning professor (a private practice adjunct) was impressed by certain avant garde aspects of what I had going on. Thus, THIS very Trust/LLC Structure was the solution I used to handle the affairs of my case study project... and get an "A" for that Estate Planning class.

However, I've actually been around "this material" even longer - since the late 90s, having begun with an IBC in Turks & Caicos with an accompanying numbered account at Anglo Irish Bank in Vienna. Consequently, after a quarter century, I know how to get bang for the buck and maximize features & benefits in the most efficient, streamlined manner possible. Yet, having a sophisticated Tax-Advantaged Estate Planning & Asset Protection Structure in place for your family begins at the beginning - figuring out WHY I'm so emphatic about the way things are done... and how this all relates to YOU. Accordingly, Your 90-Minute LAW DEGREE represents the initial conversation I'd have with everyone, if I could.

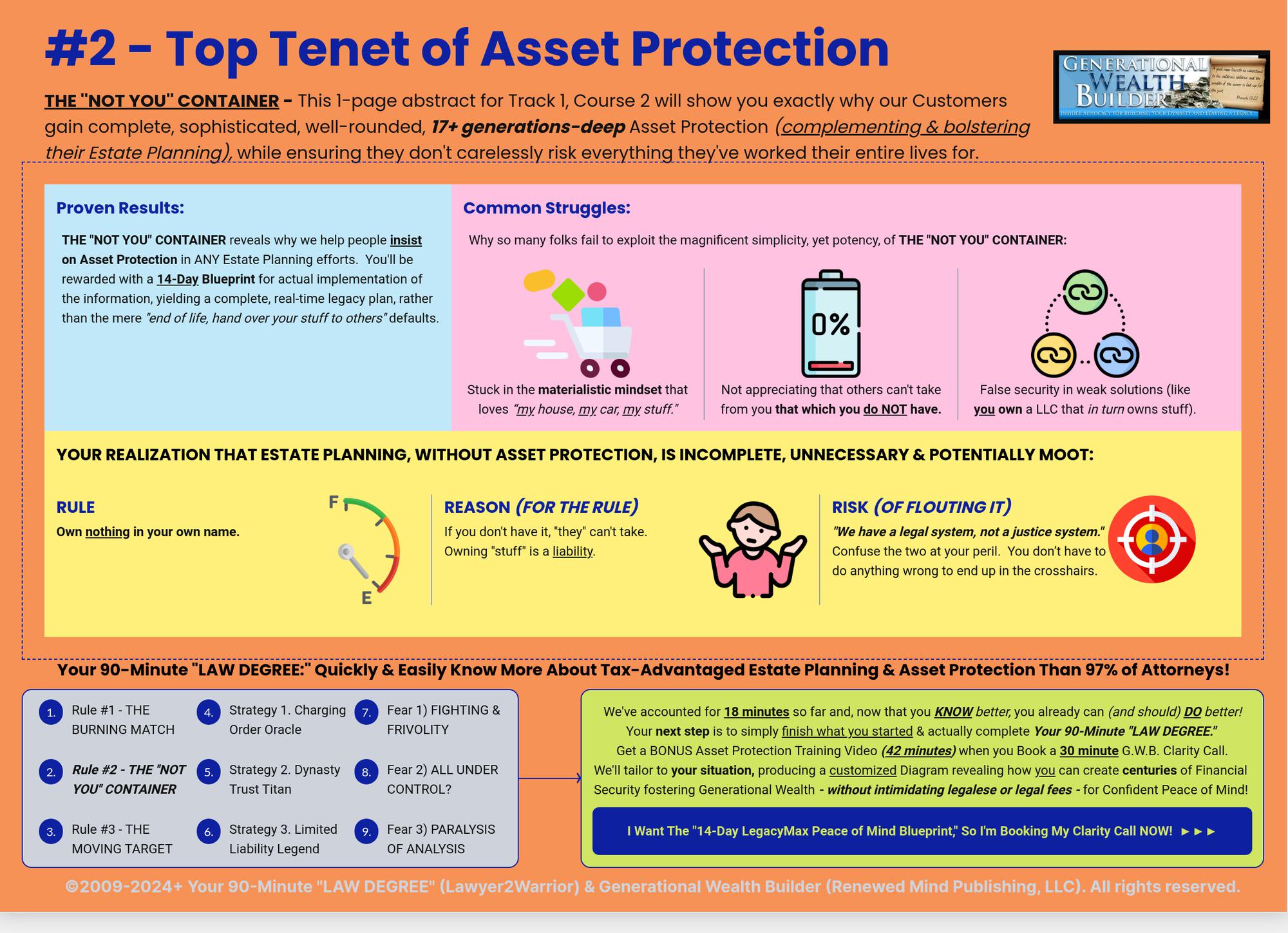

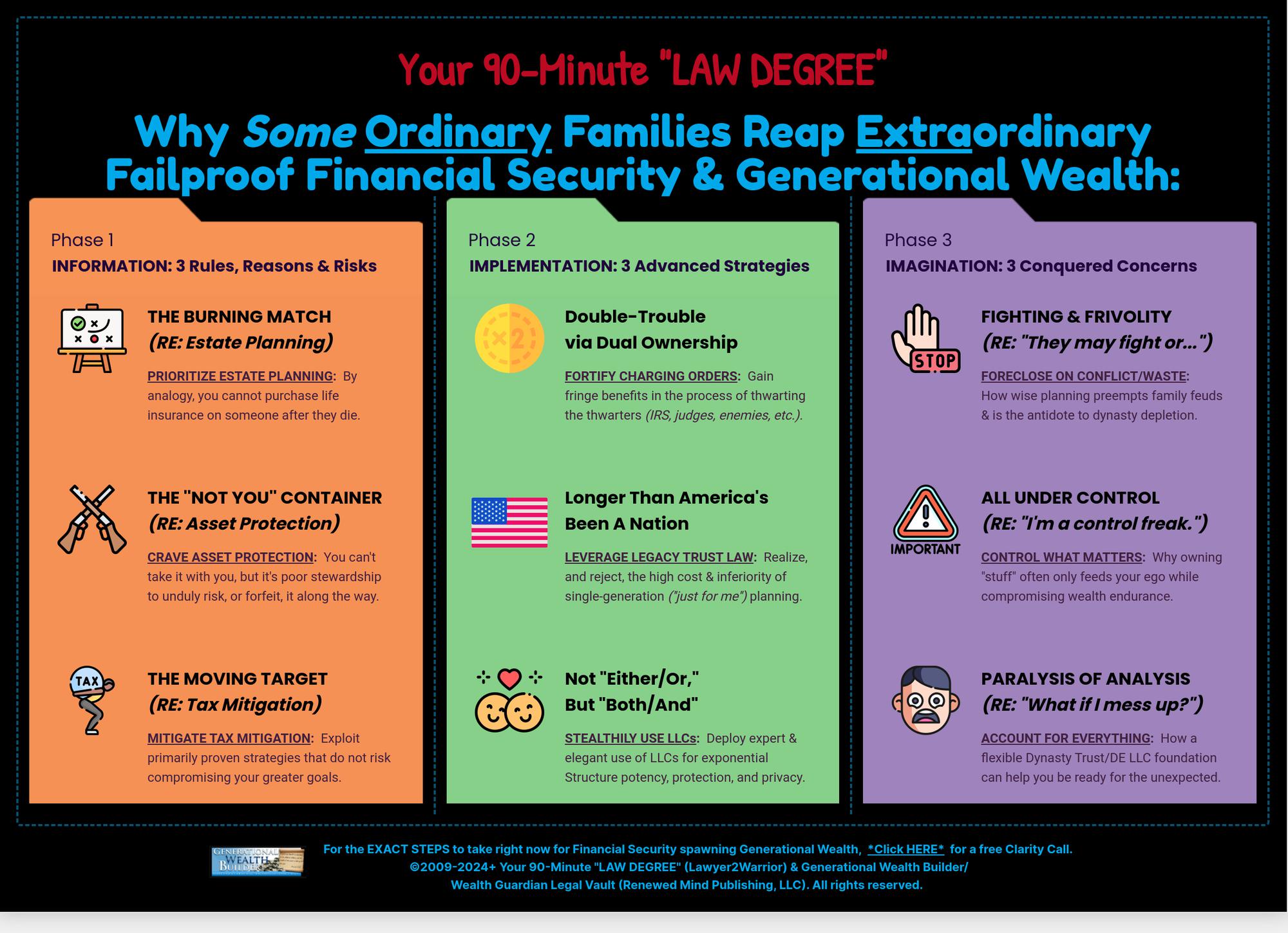

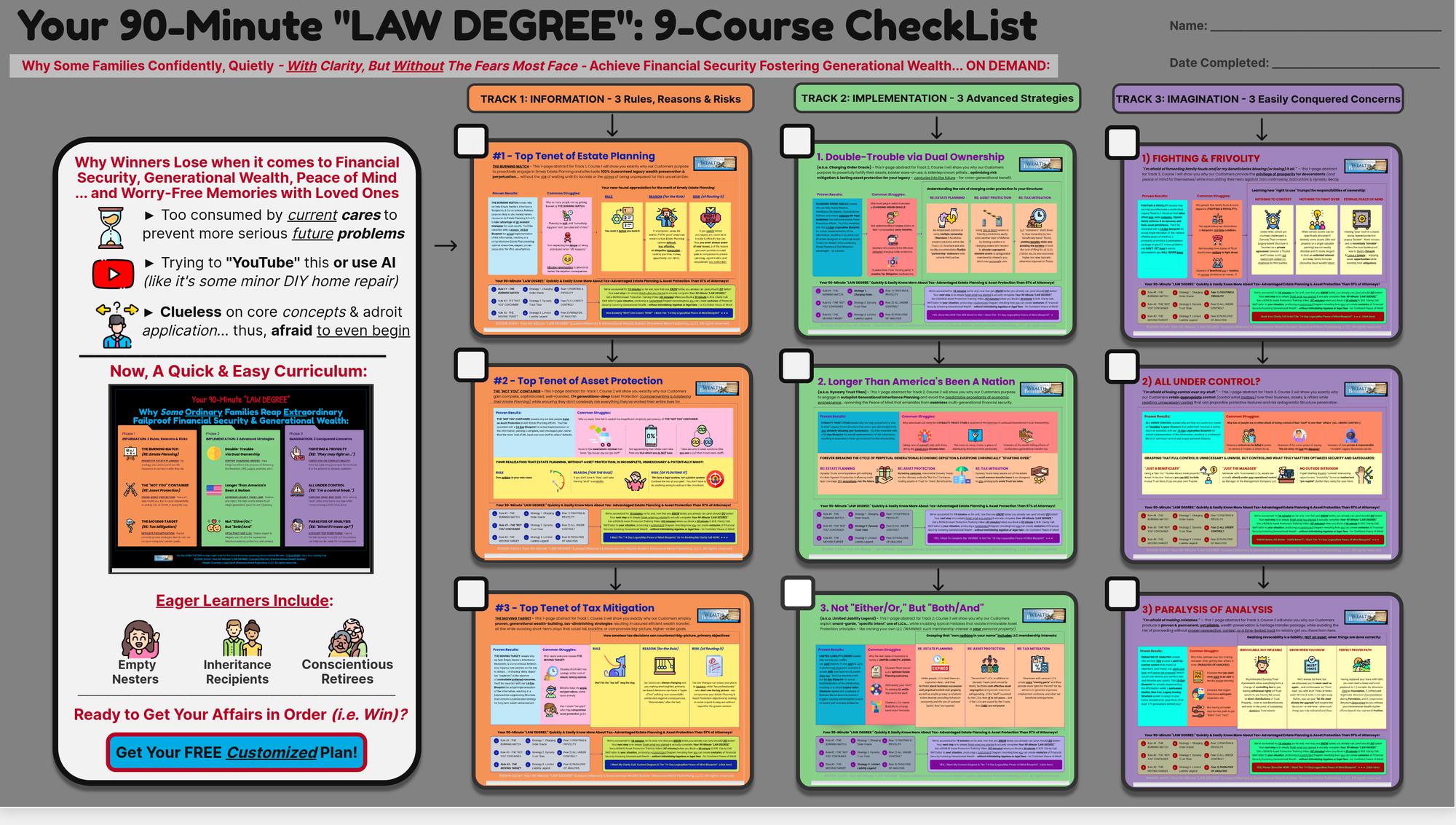

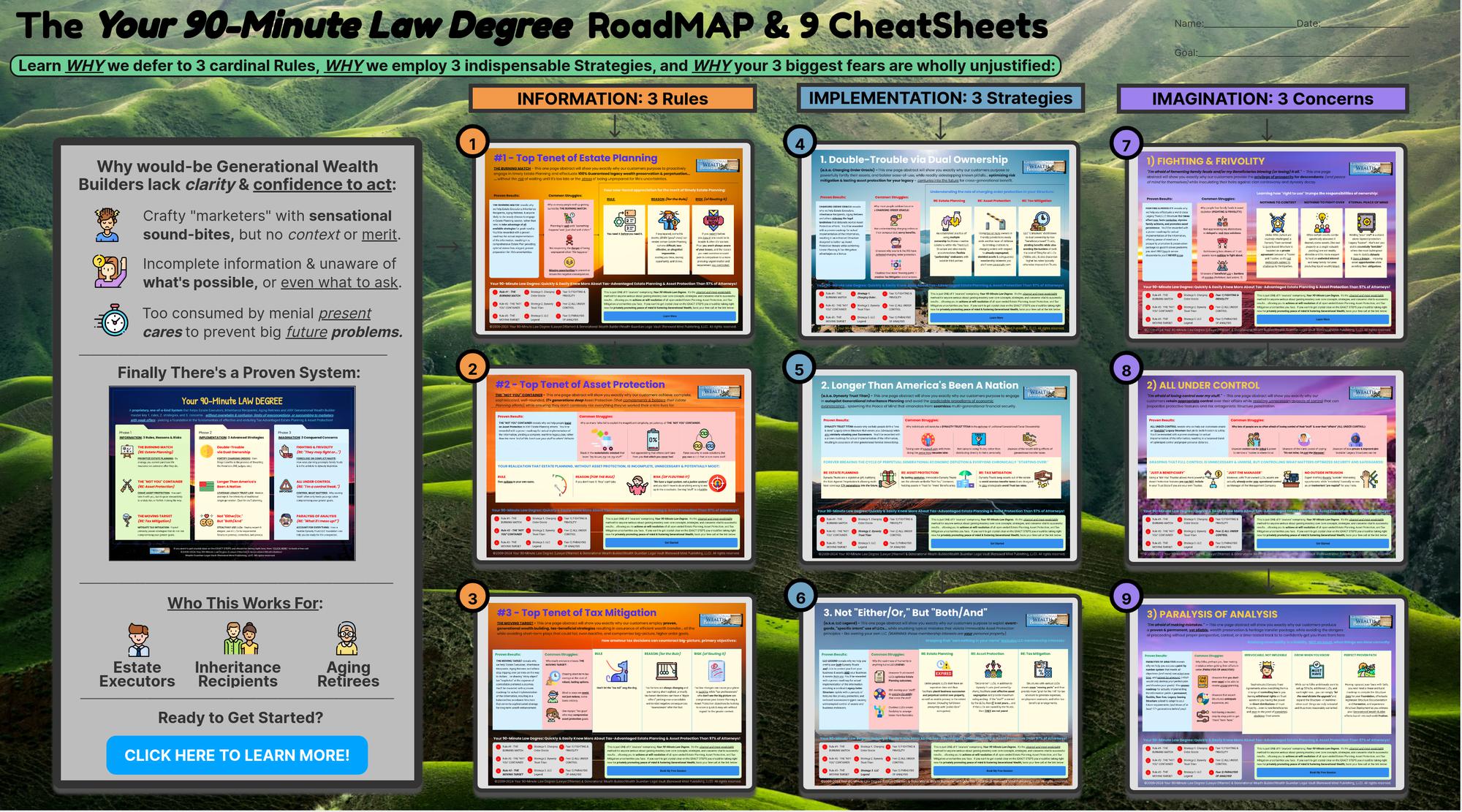

Now, I can. See, Your 90-Minute LAW DEGREE is a succinct, "perfected presentation." In a highly iterative process, I've reduced the common themes and starting points down to 3 "tracks" of material: INFORMATION, IMPLEMENTATION, IMAGINATION. In the INFORMATION Phase, you'll learn the #1 Rule across the three facets of material we address (Estate Planning, Asset Protection, Tax Mitigation). In the IMPLEMENTATION Phase, you'll discover three specific Strategies we employ... in deference to, and honoring, those three Rules. In the IMAGINATION Phase, I hammer the unfounded Fears that spawn lethargy and, ironically, fertilize the seeds of disaster people hope will never take root. After all, if your fears are not based in reality, that unjustified worry only serves disorder and precludes the Peace of Mind you otherwise could obtain.

If you want to learn WHY we do WHAT we do, this is it. I'm 100% confident you'll learn something you did not know... and be in a position to make an intelligent decision about getting your affairs in order - while there's still time.

Before I was one, years ago I hired an attorney half-way across the country to help me. That was after buying, reading, and rejecting the "solutions" shared in a number of books. Some were sketchy; others were unwieldy and unappealing. I basically knew the end goal, but lacked a clear way to "get there from here." I ended up working closely with this lawyer to put together a package that ticked all known boxes.

Next, I up & went to law school myself. I'd already studied the matter way more than most, but figured pursuit of a JD would be the best way to not only test my Trust/LLC Structure, but also see if - by chance - I could find something better. I took all the right courses - legal drafting, contracts, business associations, tax, more tax, estate planning, and so on. Not only did I not find anything better, but I also could not find a way to improve upon what I had (and netiher did I have a need to - for it'd never let me down or left me wanting). In fact, my estate planning professor (a private practice adjunct) was impressed by certain avant garde aspects of what I had going on. Thus, THIS very Trust/LLC Structure was the solution I used to handle the affairs of my case study project... and get an "A" for that Estate Planning class.

However, I've actually been around "this material" even longer - since the late 90s, having begun with an IBC in Turks & Caicos with an accompanying numbered account at Anglo Irish Bank in Vienna. Consequently, after a quarter century, I know how to get bang for the buck and maximize features & benefits in the most efficient, streamlined manner possible. Yet, having a sophisticated Tax-Advantaged Estate Planning & Asset Protection Structure in place for your family begins at the beginning - figuring out WHY I'm so emphatic about the way things are done... and how this all relates to YOU. Accordingly, Your 90-Minute LAW DEGREE represents the initial conversation I'd have with everyone, if I could.

Now, I can. See, Your 90-Minute LAW DEGREE is a succinct, "perfected presentation." In a highly iterative process, I've reduced the common themes and starting points down to 3 "tracks" of material: INFORMATION, IMPLEMENTATION, IMAGINATION. In the INFORMATION Phase, you'll learn the #1 Rule across the three facets of material we address (Estate Planning, Asset Protection, Tax Mitigation). In the IMPLEMENTATION Phase, you'll discover three specific Strategies we employ... in deference to, and honoring, those three Rules. In the IMAGINATION Phase, I hammer the unfounded Fears that spawn lethargy and, ironically, fertilize the seeds of disaster people hope will never take root. After all, if your fears are not based in reality, that unjustified worry only serves disorder and precludes the Peace of Mind you otherwise could obtain.

If you want to learn WHY we do WHAT we do, this is it. I'm 100% confident you'll learn something you did not know... and be in a position to make an intelligent decision about getting your affairs in order - while there's still time.

J. Scott Talbert, J.D., B.A. (Psychology), Ph.D. (ABD), B.A. (Theology)

Optional BONUS:

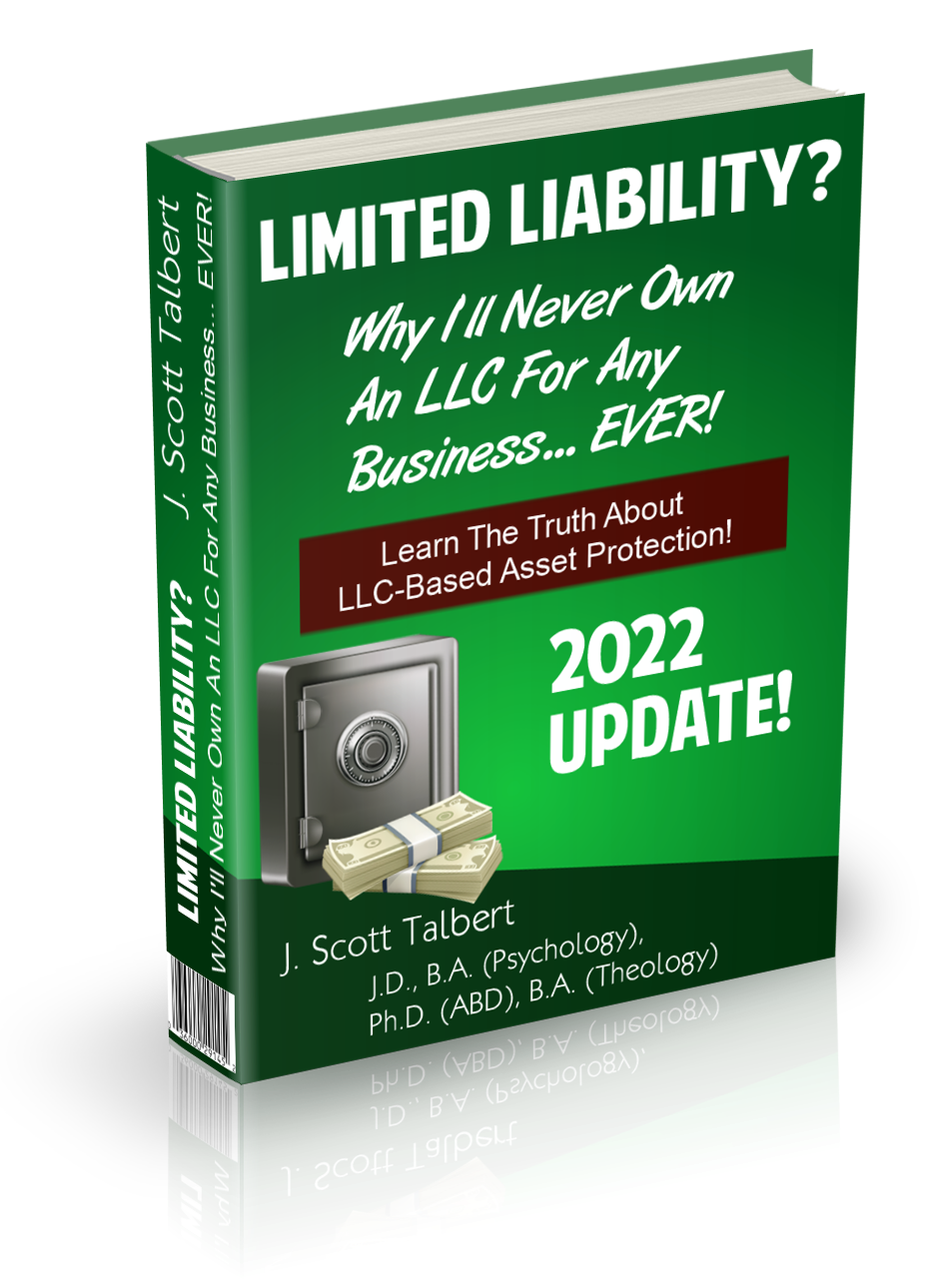

Download My book

Learn how the vast mass of people use LLCs disastrously wrong.

It's not just about protecting you from your business... ... it's also about protecting your business from you!

When you claim your copy of the RoadMAP & 9-pack CheatSheets for Your 90-Minute "LAW DEGREE," you'll also receive an Unannounced Bonus and a chance to grab a copy of "Limited Liability?" for free.

If, for whatever reason, you do not want the RoadMAP & 9-pack CheatSheets (which is weird, I must say), you can purchase "Limited Liability?" for $197 HERE.

It's not just about protecting you from your business... ... it's also about protecting your business from you!

When you claim your copy of the RoadMAP & 9-pack CheatSheets for Your 90-Minute "LAW DEGREE," you'll also receive an Unannounced Bonus and a chance to grab a copy of "Limited Liability?" for free.

If, for whatever reason, you do not want the RoadMAP & 9-pack CheatSheets (which is weird, I must say), you can purchase "Limited Liability?" for $197 HERE.

Other Publications Include:

Get the platform

"Watch me create ad copy, webinar slides, done for your courses, complete 27-step email nurture sequences, sales scripts and more - on autopilot in no time, flat. No blank screens ever..."

"Rather than face the fear and repercussions of dealing with foreclosure and loss personally, I was thankful to have a solid estate and asset protection plan in place to protect my businesses and my family."

"I highly encourage you to explore the expertise of what Mr. Scott Talbert teaches, and listen to him closely. I know from personal experience that you can never anticipate life's uncertainties, but you can plan for them. You can take the step today and safeguard your family, your business, and your assets."

"I highly encourage you to explore the expertise of what Mr. Scott Talbert teaches, and listen to him closely. I know from personal experience that you can never anticipate life's uncertainties, but you can plan for them. You can take the step today and safeguard your family, your business, and your assets."

Corey Durrer

(testimonial given when reflecting upon a personal family tragedy)

"It was 2011 when I got my Trust package put together and I have never been sorry I did. I should actually say, "WE" as this is as much for my wife and son, daughter-in-law and grandsons as it is for me! We are all benefiting from the autonomy and asset protection it furnishes. It is also a seamless way to implement protected estate planning that is streamlined and avoids probate and makes the necessities of of any exposure of private life details...or delays...or the frustration of Probate Court unnecessary!"

"What a great way to handle wealth transfer! Something the rich...famous and powerful know about well but most of us, the little guys, who are the ones getting hurt and burnt don't yet! Having this Trust structure in place has over these years opened up a lot of asset protection options and autonomy for us as well as saving us well over $75,00.00! Plus life is simplified for all parties concerned as our estate passes on to where it is supposed to go."

"It would have cost us much more to not have it than it has to have had it!!!! It is really a necessary and great tool for truly building a dynasty, even a small one, and leaving a legacy behind!"

"What a great way to handle wealth transfer! Something the rich...famous and powerful know about well but most of us, the little guys, who are the ones getting hurt and burnt don't yet! Having this Trust structure in place has over these years opened up a lot of asset protection options and autonomy for us as well as saving us well over $75,00.00! Plus life is simplified for all parties concerned as our estate passes on to where it is supposed to go."

"It would have cost us much more to not have it than it has to have had it!!!! It is really a necessary and great tool for truly building a dynasty, even a small one, and leaving a legacy behind!"

Anonymous Customer

“Insert a clients quated testimonial or your summary of their journey. If you don’t have client testimonials you can show your own results or general statistics from your industry at large”

Elenor Kiehn

Author at Panoply Store

“Insert a clients quated testimonial or your summary of their journey. If you don’t have client testimonials you can show your own results or general statistics from your industry at large”

Elenor Kiehn

Author at Panoply Store

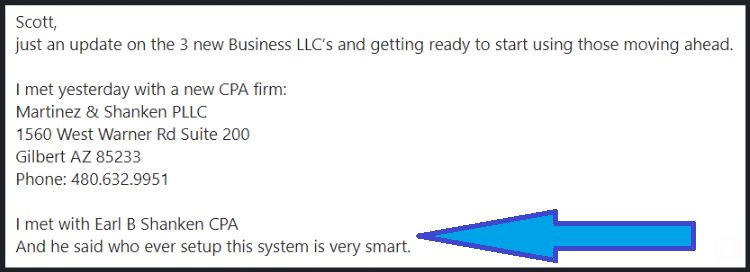

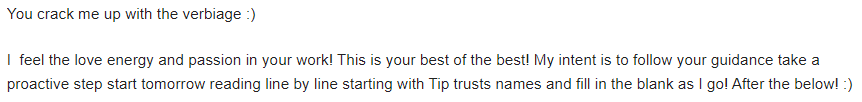

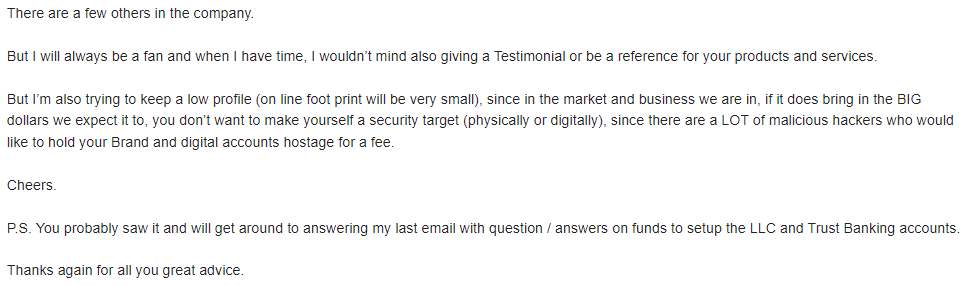

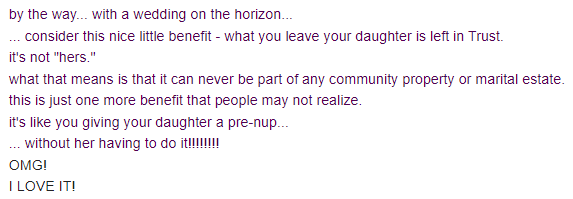

Sometimes the "non-testimonial" testimonials are best...

... like this feedback given to my Customer by a CPA:

"You're just pracitcally a genius with everything that you do."

Anonymous Customer

(testimonial by widow in the context of establishing bank accounts pertaining to a partnership in a business endeavor with another Customer, who has the same Structure)

“Insert a clients quated testimonial or your summary of their journey. If you don’t have client testimonials you can show your own results or general statistics from your industry at large”

Elenor Kiehn

Author at Panoply Store

“Insert a clients quated testimonial or your summary of their journey. If you don’t have client testimonials you can show your own results or general statistics from your industry at large”

Elenor Kiehn

Author at Panoply Store

Program Faq’s

Simply enter basic details about your business, product and audience. You have questions, we have answers to the most common questions folks like you ask us about our program.

What is Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys

The Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys is a powerful system for helping Terminally Ill, Inheritance Recipients and Aging Retirees rapidly increase their At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties in just 90 minutes without the obstacles of Too consumed by cares of the present to prevent problems of the future, Lacking knowledge in foundational principles & not knowing what to ask... or even what's possible, or Swayed by practitioners pitching the inferior options they know rather than thorough solutions that meet all goals so they can finally Access to a proven roadmap for actual implementation of your new-found information.

So if you want a crystal clear and predictable roadmap to help you Access to a proven roadmap for actual implementation of your new-found information, look no further!

How does it work?

Our approach is based on the core belief that there are three elements required for success for anyone serious about increasing their At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties as quickly as possible:

Commitment

You have to be 100% “all in,” serious about taking action, and motivated to get unstuck and achieve your goals. Without commitment, no one will ever be able to make a lasting change!

Clarity

Instead of spending days, weeks, months, or even YEARS searching, clicking, and scrambling to put together all the pieces required for success, you must follow a proven system, roadmap, or path from Point A to Point B. This is what the Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys provides: The exact formula you need to get where you want to go with little to no overwhelm or information overload.

Confidence

The final element is confidence knowing you have dedicated support and coaching to help you customize our proven roadmap to your specific situation. This helps keep you accountable and maintains forward momentum.

We’re in this together!

So if you’re frustrated with the current state of your At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties, we have the clear path to follow and unparalleled support to help you reach your goals.

You have to be 100% “all in,” serious about taking action, and motivated to get unstuck and achieve your goals. Without commitment, no one will ever be able to make a lasting change!

Clarity

Instead of spending days, weeks, months, or even YEARS searching, clicking, and scrambling to put together all the pieces required for success, you must follow a proven system, roadmap, or path from Point A to Point B. This is what the Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys provides: The exact formula you need to get where you want to go with little to no overwhelm or information overload.

Confidence

The final element is confidence knowing you have dedicated support and coaching to help you customize our proven roadmap to your specific situation. This helps keep you accountable and maintains forward momentum.

We’re in this together!

So if you’re frustrated with the current state of your At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties, we have the clear path to follow and unparalleled support to help you reach your goals.

How is this different from other things I have tried?

Great question! If you’re reading this right now, there’s about a 99.999% chance you’ve spent more than a fair amount of time and money trying to reach your At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties goals.

There’s little doubt that you’ve probably clicked on countless ads, consumed more than a healthy dose of blogs or videos, and purchased more than a few courses - all from self-proclaimed experts and gurus who say they can help you Access to a proven roadmap for actual implementation of your new-found information overnight.

Heck, if you’re like most of our clients, you may have even invested a hefty amount in coaches, courses, and other At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties products...

But you’re here because you’re most likely still struggling with Too consumed by cares of the present to prevent problems of the future, Lacking knowledge in foundational principles & not knowing what to ask... or even what's possible, and/or Swayed by practitioners pitching the inferior options they know rather than thorough solutions that meet all goals...

Am I right?

We’ll here’s why: You’re likely not following a complete system or roadmap for doing ALL OF THE THINGS required in the right order, to get yor At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties where you want it to be. Instead of wasting your time stuck in a state of complete information overload, trying to duct tape together all the pieces required for success, our Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys Course provides a crystal clear step-by-step pathway to reach your destination!

Am I right?

We’ll here’s why: You’re likely not following a complete system or roadmap for doing ALL OF THE THINGS required in the right order, to get yor At-will resolution of all open-ended Estate Planning, Asset Protection, and Tax Mitigation uncertainties where you want it to be. Instead of wasting your time stuck in a state of complete information overload, trying to duct tape together all the pieces required for success, our Your 90-Minute Law Degree: Quickly & Easily Know More About Tax-Advantaged Estate Planning & Asset Protection Than 97% of Attorneys Course provides a crystal clear step-by-step pathway to reach your destination!

How do I know if this will work for me?

After spending the last several {insert timeframe} helping Terminally Ill, Inheritance Recipients and Aging Retirees, we have honed our systems down to an exact science.

The best way for both of us to gain 100% confidence that this is the absolute best way for you to reach your goals is to jump on a short call so we can get clear on the exact steps you should be taking based on your specific background and situation.

Book a call {HERE}.